The Irish Haemophilia Society and other charities are facing an uncertain financial future as we continue to improve and increase our programmes, conferences, activities and publications for the benefit of our ever increasing number of members and families with haemophilia and bleeding disorders. This increased workload and requirement for additional funding was taking place amidst a backdrop of decreasing core funding from the government. In order to allow us to continue to improve our services to members, we are working to expand and diversify our funding base to include additional corporate and fundraising income. We hope that you, the members of the Society, will play an active role in allowing the organisation to thrive in the future by positively considering donating to the Society for a five year time period on a planned giving basis.

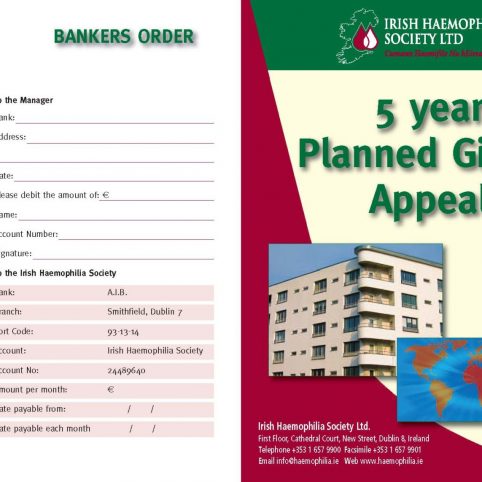

We have an apartment facility in Dublin 8, for the use of our members and families who need accommodation linked to increased visits to their treatment centres. By signing up for the Planned Giving programme you are helping the Society pay for the running cost of the apartment facility for members.

Contributions to our Planned Giving Campaign, can start from as little as €10 per month. However, if you choose to contribute €21 or more per month, the I.H.S. as an eligible charity, can benefit from tax relief from the Revenue Commissioners, in respect of donations. Your monthly gift can go even further, at no extra cost to you.

Planned Giving Donation Levels

Platinum €1,000 annually or €80 per month

Gold €600 annually or €50 per month

Silver €300 annually or €25 per month

Bronze €100 annually or €10 per month

If you would like more information, or would like to request a bankers order form, please contact Nina or Debbie in the office on 01 6579900. Thank you for your support.

[The Irish Haemophilia Society is a registered charity and donations are tax deductible.]